❯ steps to buying a house?

| 07-18-2012, 03:20 PM | #90 | |

|

Lieutenant

101

Rep 460

Posts |

Quote:

|

|

|

Appreciate

0

|

| 07-18-2012, 03:22 PM | #91 |

|

Banned

707

Rep 1,908

Posts |

|

|

Appreciate

0

|

| 07-18-2012, 03:35 PM | #92 | ||

|

There is No Substitute

79

Rep 1,186

Posts |

Quote:

Quote:

Also, your article is from 2009. Good luck getting financed at 5% from a private lending institution in 2012.

__________________

'13 Audi A6

'07 Porsche GT3 RS '08 BMW E90 335i  |

||

|

Appreciate

0

|

| 07-18-2012, 04:34 PM | #93 |

|

Captain

164

Rep 709

Posts |

in that article it says a 720 score is very good but that was in 2009. How about in todays standards. Mine is about 720 as of today because in the past 12 months I've had over 10 Inquiries. All my debts will be paid off by the end of the year and my credit report activity will be dormant until early 2013. I'm 36 with 3 dependents with a net of 80k/year. I have enough for 20% DP on a $200k house but I don't want to if i don't have to. Am I approved?

__________________

|

|

Appreciate

0

|

| 07-18-2012, 04:55 PM | #94 | |

|

Lieutenant

69

Rep 550

Posts |

Quote:

I had barely over a 750 when I bought, and was warned that if I dropped to a 749 before closing the rate would go up. This was Nov 2011. |

|

|

Appreciate

0

|

| 07-18-2012, 05:08 PM | #95 |

|

Captain

164

Rep 709

Posts |

That's what I'm afraid of. i might just wait a little longer to buy. that way i can save up some more and hope the market don't pick up anytime soon. What do you think the market will look like next year or so. After Romney becomes president..

__________________

|

|

Appreciate

0

|

| 07-18-2012, 05:34 PM | #96 | |

|

Private First Class

16

Rep 158

Posts |

Quote:

On our purchase contracts there are boxes to be checked indicating who pays for what. I presumed all states had similar boxes. Curious to know if that is the case now. |

|

|

Appreciate

0

|

| 07-18-2012, 05:54 PM | #97 |

|

Registered

4

Rep 4

Posts |

all you need to get aprove is 630 for FHA..bank is 700

all the articles you guys are quoting is 6 months behind... i do this for a living- i'm on the frontline of this real estate stuffs.... all the people saying that putting 20% down are real dumb (consumers), they dont know anything with real estate and finances...... putting 20%-30% down means that you think you are going to live in that house forever unit pay it off.....

let me tell you something, a house is a tool that you use and change, upgrade, move, and etc..... you are not your parents that buys and stay there forever.... this generation, a house is live in 3-5 years....why would you put down lots of $$$ and not have a rainy day backup $$$..... |

|

Appreciate

0

|

| 07-18-2012, 06:13 PM | #98 | |

|

Captain

164

Rep 709

Posts |

Quote:

__________________

|

|

|

Appreciate

0

|

| 07-18-2012, 06:16 PM | #99 | |

|

Banned

707

Rep 1,908

Posts |

Quote:

Actually, that article touches on every single point I made. Definition: Private mortgage insurance, often referred to as PMI, is insurance that lenders require borrowers to pay for when they get a mortgage and don’t have enough equity in the home. http://financialplan.about.com/od/re...minate-PMI.htm -On post #45, I said a PMI is levied by the lender on a homeowner who doesn't put 20% down to offset the lack of equity in the home. It's the lender's insurance per se to protect them. Once enough equity is reached the PMI ceases, thereby lowering their mortgage payment anyway. YOU SAID OTHERWISE and you're wrong! -Initially, you argued the 20% rule. I said otherwise considering our current economic climate. The article, if you want to reference that, detailed in plain view, how qualifying for an FHA loan with less down actually can yield a lower interest rate than a conventional loan. And that banks often see large down payments as riskier since much of their emergency funds are depleted. YOU SAID OTHERWISE and you're wrong! -The article said one should maintain several months of mortgage payments, I have championed that same advice since I entered this thread and advised those to save some of that large down payment in the event of an emergency. -The article you posted mentioned Freddie Mac and Fannie Mae, no? Well, the article I posted quoted a spokeswoman for Fannie Mae and she herself said those who put down 20-25% are the RISKIEST to lenders. How could that be? Well, they don't carry a PMI. So, that little fact completely destroys your very poor advice you're giving to people on this site, buddy. BTW, I have a 3.3. So, have no idea what the heck you're talking about but, then again you think it's not a good time to purchase a home, so what do I know.... |

|

|

Appreciate

0

|

| 07-18-2012, 06:48 PM | #100 | |

|

Lieutenant

69

Rep 550

Posts |

Quote:

I put 20% down and have more than another 20% for a rainy day. Does that still make me "real dumb"? Does that mean I "don't know anything about real estate and finances"? Real estate isn't a business for everyone. My home isn't a "tool". It's my home. |

|

|

Appreciate

0

|

| 07-18-2012, 07:38 PM | #101 |

|

Registered

4

Rep 4

Posts |

you are just a consumer- thats all you know

consumers only know to spend $$$, they dont know how to keep or make big money.... take away the your job and things fall apart.... businessmen knows when to put out money and when to keep the money. I'm trying to tell you how to work the system, not be the system....

|

|

Appreciate

0

|

| 07-18-2012, 07:48 PM | #102 | |

|

There is No Substitute

79

Rep 1,186

Posts |

Quote:

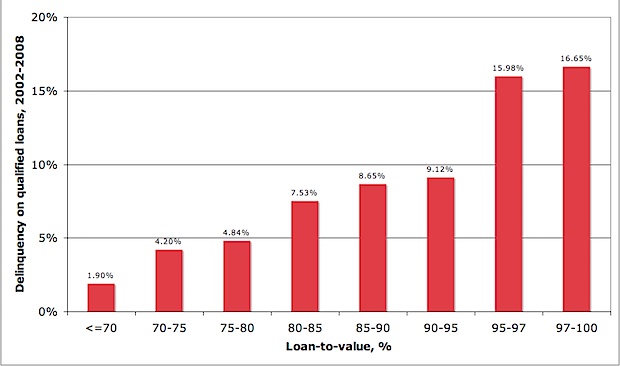

Here's actual statistics showing delinquencies by down payment amount:   From 2002-2008, people who put down 3% were FOUR times likely to default than people who put down 25%. These are actual delinquency statistics recorded by the mortgage industry. All lower down payments does is increase the size of the market, but in doing so it raises the rate of default. This is statistical fact, not opinion. As I said before, your advice is horrible.

__________________

'13 Audi A6

'07 Porsche GT3 RS '08 BMW E90 335i  Last edited by MediaArtist; 07-18-2012 at 08:01 PM.. |

|

|

Appreciate

0

|

| 07-18-2012, 07:59 PM | #103 |

|

Banned

707

Rep 1,908

Posts |

How about you address all of the fallacies you are promoting in this thread and give the graphics a break, huh? I addressed everything you spewed yet you can't

rebut any of it. I call that being intellectually dishonest. I'll give you a second chance instead of dodging my clear points. |

|

Appreciate

0

|

| 07-18-2012, 08:10 PM | #104 | ||

|

There is No Substitute

79

Rep 1,186

Posts |

Quote:

Quote:

The lowest FHA rate as of 7/18/12 can offer for a 30 year fixed is: 3.791% The lowest conventional 30 year fixed is: 3.673% When you go 15 year fixed it gets even worse, FHA: 3.433%, Conventional: 3.091% So basically, your advice is based on an outdated faulty premise. I think the only "clear" point here is that your advice is horrible. Now why don't you address the fact that lower down payments (like you're suggesting) lead to higher rates of default?  In fact, I know you can't answer it, so let's try something you will understand. Why don't we have a gentleman's bet to settle this issue? Let's say a small amount of $1,000. I'll bet you that FHA delinquency will rise in the next 3 months, because low down payment financing, and a system based on it, simply doesn't work. So by October 18th, 2012 (or so), I will bet you $1,000 that FHA delinquency will rise, rather than go lower. If what you're saying is true, that low down payments work, you should take my $1,000 without much effort. If however delinquency does rise (anything above a 0% increase), then you owe me $1,000. We can have a moderator hold the checks, or do donations to our favorite non-profit. Are you game?

__________________

'13 Audi A6

'07 Porsche GT3 RS '08 BMW E90 335i  Last edited by MediaArtist; 07-18-2012 at 08:21 PM.. |

||

|

Appreciate

0

|

| 07-18-2012, 08:38 PM | #105 |

|

Captain

164

Rep 709

Posts |

It makes sense that for people who put lower DPs it's easier for them to walk away if shit hits the fan vs. someone who's invested more money for their home. I think we all get that..

__________________

|

|

Appreciate

0

|

| 07-18-2012, 09:22 PM | #106 |

|

Registered

4

Rep 4

Posts |

most people this- most that,, guys on this site are mid to high income- no def here

if you are on this forum and drive at lease a BMW, you have nothing to worry about....

|

|

Appreciate

0

|

| 07-18-2012, 09:28 PM | #107 |

|

Registered

4

Rep 4

Posts |

all that graphic dont mean anything, gettin a loan in 2003-2008 was easy, no job need

a loan does days were EASY....no job needed, no doc, just a credit score.... U could get a loan for a dead guy or a bum

|

|

Appreciate

0

|

| 07-18-2012, 09:41 PM | #108 |

|

Captain

164

Rep 709

Posts |

thats where the problem was. and I've seen it happen. People selling their SS # numbers for $5-$10k to agents/brokers to flip a house.

__________________

|

|

Appreciate

0

|

| 07-18-2012, 10:08 PM | #109 | |||

|

Banned

707

Rep 1,908

Posts |

[QUOTE=MediaArtist;12351096]You mean ignore facts that your advice about low down payments is horrible? Okay, let's ignore the fact that your advice would leave people 4x more likely to default than someone who follows my advice and address your "clear points".

[quote] I don't recall asking you a question but, since you feel compelled to speak on his behalf, I'll play... First of all, I said put as little down as possible. In most cases, that qualifies as a 3.5% for FHA. Your 20% down-payment, as was said recently, is for your parent's generation who intended to live and die in the first house they bought. People move way more frequently nowadays. Career change rapidly. Economies dry up. Save your damn cash and work the system. Putting little down does not imply one is being financially irresponsible. What works for you may not work for them. It will take some years to save 20% on a home. Should they miss an opportunity to buy low just because of some outdated rule you live by? But again, everyone on this site dates super models and runs the top hedge fund. I love the ideal internet world. Quote:

Here's 2011. Happy? Remember the Red Queen’s warning to Alice? “It takes all the running you can do, to keep in the same place. If you want to get somewhere else, you must run at least twice as fast.” That must be what it feels like to be saving up for a down payment on a home these days. Washington policymakers are entertaining several proposals that would raise the minimum down payment required for loans backed by Fannie Mae and Freddie Mac. Lenders are raising their own minimum cash requirements — the average down payment on new loans for home purchases is now around 27 percent, according to the Mortgage Bankers Association of America. Meanwhile, the Federal Housing Administration, the chief source of low down payment loans, is raising the fees it charges folks who only have minimal amounts of cash to the table. Trying to save just the standard 20 percent? That could take you 14 years if you’re an average middle-class family looking for an average middle-class house, the Center for Responsible Lending reported recently. If you save $250 a month, it would take nine years to save a 10 percent down payment and six years to save a five percent down payment. And that doesn’t seem to pay. If you think about the cost of paying rent for five or more years, you may be better off jumping into a home with a low down payment now. That’s true even if you have to spend more money on fees and mortgage insurance to get one of those low down payment loans. While nobody can predict interest rates with certainty, it seems unlikely that the mortgage terms you’d face down the road would be as favorable as they are now, with the Federal Reserve holding short term rates close to zero, and the government still backing loans via Fannie Mae and Freddie Mac. Even if you have the money for a bigger down payment, there can be good reasons to save your cash. Mortgage rates continue to skirt all-time lows: Why not put your money to work for yourself and borrow as much as you can reasonably afford, on a monthly basis, at today’s rates? You can put the money you’re not paying into a down payment to work elsewhere. If home values rise, you will have done your best to leverage a small down payment into bigger equity. If they fall, you’ll have less skin in the game, and that could put more pressure on your banker to improve your loan terms lest you walk away. The most popular source of low-down payment loans is the Federal Housing Authority, which backs loans that cover as much as 96.5 percent of a home’s value. To get one of those 3.5 percent down payment loans, though, borrowers have to pay one percent up front and annual mortgage insurance premiums. Beginning on April 18, those premiums will rise 0.25 percentage points, to 1.1 percent for borrowers who put at least five percent down, and to 1.15 percent for borrowers who only put 3.5 percent down. That may seem like a big price to pay, but the FHA plan buys you a couple of advantages. An FHA loan may get you into the house years earlier, while rates and housing prices are low. And the actual mortgage rates for FHA loans are lower than traditional loans. Consider these figures calculated by Keith Gumbinger of HSH.com, a mortgage research firm, on the purchase of a $250,000 home: * With a 3.5 percent down payment, you’ll need $8,750 in cash for the down payment plus $2,412 for the initial buy-in fee. At 4.87 percent interest, your monthly payment would be $1277 $1,507. * With a five percent down payment, you’ll need $12,500 for the down payment and $2,375 for the buy-in fee. At 4.87 percent, your monthly payment would be $1,474. You’d need $3,713 more up front than with the 3.5 percent loan, and you’d pay just $33 a month less. It would take more than nine years of lower payments to make up for that $3,713. * With a 20 percent down payment, you’ll need $50,000 for the down payment. There would be no upfront fee and no monthly insurance premium. But your rate would be higher, at 5.01 percent, based on today’s averages. Your monthly payment would be $1,075 — $399 less than the five percent loan and $432 less than the 3.5 percent loan. You’d have to save an additional $37,500 (how long would that take?), and it would take more than seven years of those lower mortgage payments to catch up. It looks like the less you put down, the better off you are. And if that extra monthly payment really starts to annoy you after seven or nine years, you can always refinance. With all of your payments and a little good luck in your market, you’ll have enough equity to avoid the mortgage insurance by then. Source: http://blogs.reuters.com/reuters-mon...ayment-sucker/ Quote:

BTW, saving cash and using someone else's money to benefit you is not an outdated premise. And 3 years is not outdated unless you're talking about iPhones.  The interest rates are at their lowest in 2012, so if their idea ran true in 2009, common sense would tell you it's even more favorable now. The interest rates are at their lowest in 2012, so if their idea ran true in 2009, common sense would tell you it's even more favorable now. [quote] Now why don't you address the fact that lower down payments (like you're suggesting) lead to higher rates of default?  Ironically, my 2009 article is "outdated" yet you want me to examine a graph from a blog, no less, that goes back to 2002, absent of any actual formulas, but plastered with charts. If you've been paying attention FHA loans AND conventional loans have revamped the lending methods and the requirements are far tighter than your "outdated" blog chart. During that period, predatory lending was in full affect, so it doesn't take a scientist to understand why FHA loans default at a higher rate. They were approving $500K homes to people earning $40K/year. If you really want to see the benefits of lower down payments using any of these loans, you would need data for the next 10 years. Quote:

How about we put on boxing gloves and the best boxer's point wins? Are you game?  Sounds about as juvenile as your attempt to be self-important on the internet, doesn't it? Sounds about as juvenile as your attempt to be self-important on the internet, doesn't it? $1000? What a character. Is that how you play a big wig online? You're really feeling yourself. Like seriously. As I said, predatory lending and shady underwriting during the boom of FHA loans is the chief cause of defaults. During this period, this loan type was most attractive to buyers and saturated the lending market, hence the reason for what we see today. But this topic is a small caveat to the bigger point, which was, 20% down is not necessarily the best formula for attaining a home in 2012. Capitalizing on low interest rates now, or miss it by saving is a choice that shouldn't be that difficult. |

|||

|

Appreciate

0

|

| 07-18-2012, 10:54 PM | #110 |

|

Private First Class

16

Rep 158

Posts |

|

|

Appreciate

0

|

Post Reply |

| Bookmarks |

| Thread Tools | Search this Thread |

|

|